With the release of its CGV coin, Cogito Protocol is presenting an AI-powered solution in the Crypto space that will change the world. This revolution will begin on SingularityDAO, Seedify, GeniusX, and EnjinStarter on June 2nd 2023.

The Cogito protocol provides a framework that creates “tracercoins”, which are digital assets with low volatility. These tracercoins are an entirely new asset class – AI-powered, Fiat Independent and have the potential to become the dominant form of exchange and value storage mechanism.

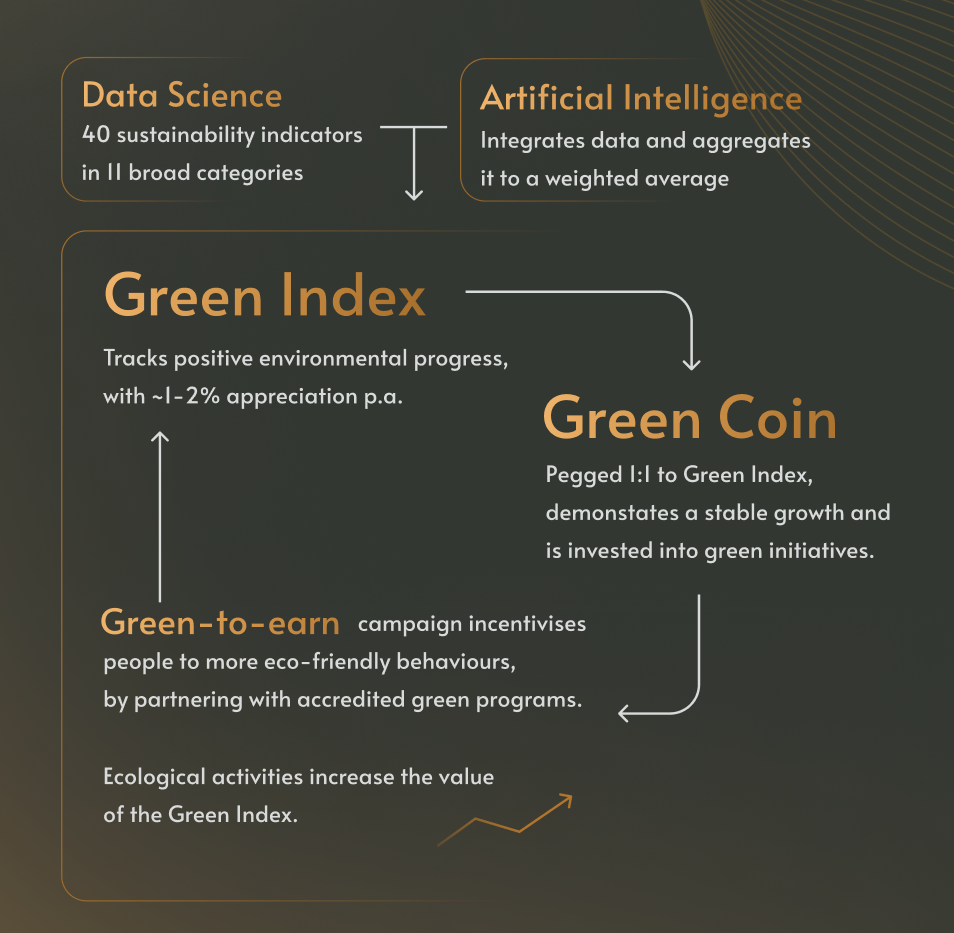

These digital assets are designed to offer stability without being directly correlated to traditional currencies or commodities. Instead, they are linked to non-financial indices that represent human progress, with an example of a GCOIN being pegged to an environmental Green Index.

The Important Details to Know About CGV

The Cogito Protocol is launching the CGV Token Generation Event (TGE) on June 2nd 2023. Sales will start from 29th May 2023 across the various platforms mentioned below. The Cogito Protocol’s governance and utility token, CGV, will enable the community to directly contribute to the roadmap of the project and influence various parameters of tracercoin

The total supply of CGV will follow a predetermined distribution:

More detailed information about the TGE and Cogito Tokenomics can be found here.

Disrupting the Crypto Sector with Tracercoins

Cogito is transforming the crypto sector with its innovative tracercoin concept. Tracercoins are digital assets pegged to non-financial indices and maintain their stability through soft pegging.

The system consists of a data layer and an AI tool layer, which generate a Green Index. This index tracks positive progress towards a net-zero economy with roughly 1-2% appreciation.

GCOIN is the first tracercoin coming from Cogito, and it traces the Green Index on a 1:1 basis.

To maintain the peg, Cogito has implemented a mechanism known as the ‘Capital Adequacy Ratio’ that works as a foundation for a number of underlying functions.

Extensive financial modeling ensures that the tracercoins offer users stable deposit rewards and are financially stable over the long term.

The team’s paper on Academia.edu provides more information and simulations. Through its tracercoins, Cogito is disrupting the crypto sector and providing a much-needed solution to the challenge of price volatility. Check here for more information on the team behind Cogito Protocol.

About Cogito

Cogito Protocol is a spin-off of SingularityNET, a renowned AI-oriented company. Cogito offers a framework for creating tracercoins, which are a new class of assets that range from low to medium-volatility growth assets. This approach helps attract a diverse, global investor base with a low to medium risk appetite.

Cogito applies the highest standards of risk management schedules for regulatory compliance, asset protection, and market integrity. The roadmap has five phases: ecosystem integration, extended portfolio, risk-weighted reserve, multi-chain presence, and use cases outside crypto.

By employing SingularityNET’s AI technology, Cogito offers users unparalleled capital deployment and risk management opportunities. Anyone wishing to discover this upcoming project can visit the team’s website. The social media pages below are also a more than valid source of information.

Twitter | Telegram | Linkedin | Medium | Discord

Enquiries related to Marketing/ Business/ PR, do contact us here.